Hey friend,

The latest data on the Fed’s preferred inflation gauge – the PCE index – came out this morning.

The annual numbers came in at 3% annually – in line with expectations – but a clear sign that inflation is still trending very much above target.

We also got the fourth-quarter GDP data, which came in at a meager 1.4% – far below the expected 2.5%.

And new consumer sentiment data showed consumer sentiment posting a slight rise, but still coming in below expectations.

Finally, the latest gauge of services and manufacturing activity, both of which showed a continued – albeit slight – growth in both sectors.

With so much data being released today, let’s see how markets have been moving.

The Daily Direction

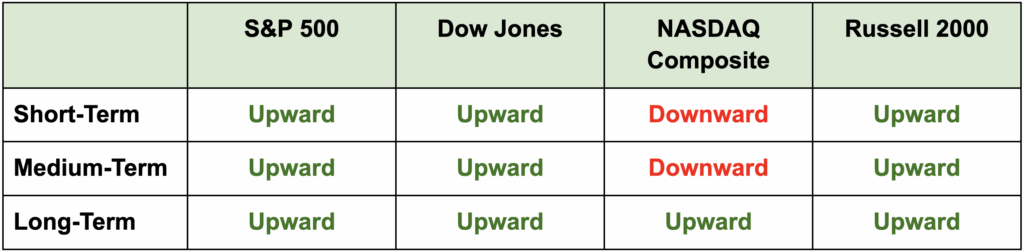

Note: Indexes closed largely lower yesterday, but have been moving higher today – sending the short and medium-term directions for the S&P 500 back upward.

The Daily Nugget

Remember that the job of the news is NOT to help you make money.

It’s so easy to get sucked into the news today.

And in the markets, there is a level of necessity in remaining “up to date” – so it’s easy to justify reading the financial news.

Now, while we would never suggest cutting yourself off from the news…

We want to remind you of one important thing:

The job of the news is NOT to help you make money.

Their job is to drive clicks and farm engagement so you watch their ads.

And to that, that means they will prioritize showing you things that will spike your emotions…

Not things that are actually useful and will help you move the needle in your own trading.

When reading the news you need to develop a keen eye…

A filter that will allow you to strip away the emotion – and find the useful information beneath (if there are any, many times there aren’t).

Like many things, this is easier said than done.

But the more you do it, the easier it will become.

So before you head off for the weekend, keep this reminder in mind…

The news is there to profit off your attention – not help you profit in the markets.

Enjoy the weekend.

The Traders Agency Team