Hey friend,

We got the big CPI inflation data this morning.

It came in right in line with expectations at a 2.7% annual increase and a 0.3% monthly one.

However Core CPI actually came in slightly below expectations at 2.6% annually and 0.2% monthly (versus the expected 2.8% annually and 0.3% monthly).

Let’s see how markets have been moving.

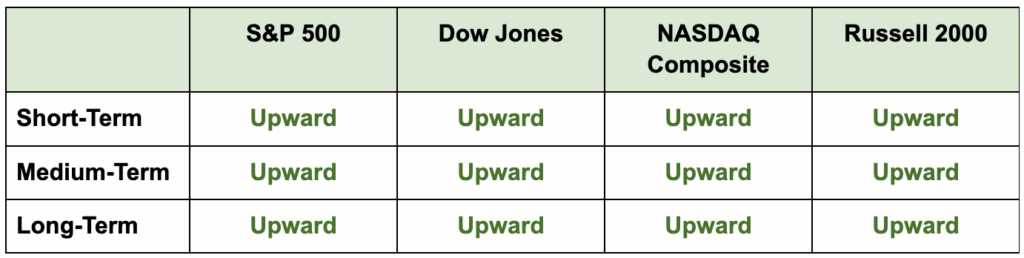

The Daily Direction

Note: Despite an initial negative reaction to the news of Fed Chair Powell’s potential prosecution, markets closed slightly higher yesterday. All index directions remain upward.

The Daily Nugget

The news tells you what you should think. The price tells you what people are actually thinking.

The news tells you what you should be thinking all the time.

In politics they tell you that this side or that person is the enemy (or ally).

And in finance they tell you whether this or that stock is a winner or a dud.

Now, don’t get it wrong…

Those opinions can absolutely be useful…

But the only thing that can tell you what people are actually thinking – is the price.

Because price doesn’t show opinions – it shows action.

And action is the only thing that can really move markets.

Right now, there’s a lot of news flow about things that could ostensibly move markets.

There’s the so-called witch hunt against Fed Chair Powell.

There’s the potential new tariffs on any country doing business with the Iranian regime.

There’s the whole situation in Venezuela – and potentially Greenland.

There’s the question of the balance between weaker jobs data and the potential of reigniting inflation.

Sure, all these do indeed have the potential to move markets.

And savvy traders and investors are most definitely keeping tabs on them via the news.

But if you want to really know what the mass of investors are thinking about all these events…

Forget the news – and look at the price instead.

Head Trader Ross Givens is an expert of breaking down how the newsflow translates into real-time price action…

And using it to spotlight opportunities that most people miss.

He shares a lot of this analysis in his newsletter, so do your best to catch it.

The next edition will be out tomorrow morning.

The Traders Agency Team