Hey friend,

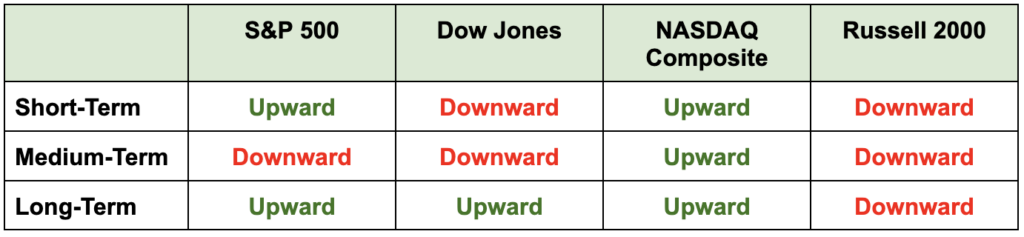

The market bounce is starting – and you can see that by looking at how much greener the table below is looking compared to just a week ago.

The Daily Direction

Note: Treasury yields and the dollar are once again pulling back, and the market is rising. The S&P 500’s short-term direction, the Dow’s long-term direction, and the Nasdaq’s medium-term direction all flipped back upward. And a couple more are on the verge of flipping too.

The Daily Nugget

Disciplined risk management is what allows you to confidently go after the best opportunities.

Too often, beginner traders think of disciplined risk management practices as “holding them back”.

They think it’s overly restrictive – that it prevents them from taking advantage of the most lucrative opportunities.

The truth is, it’s the opposite.

Disciplined risk management protects your downside so you can survive the market going against you (which WILL happen).

And when you know you can survive, you can also confidently go after the best opportunities – giving yourself the highest potential upside.

So don’t think of disciplined risk management as a constraint – but an advantage.

Case in point is the market bounce that’s starting to happen right now.

There’s a big opportunity there…

But if you go all in without disciplined risk management – you’re going to get burned.

That’s why Ross Givenswants to show you the smart way to play this bounce…

And you can do that by clicking here to start following his flagship strategy.

The Traders Agency Team