Hey friend,

No major data released today or early next week.

It’s just a raft of Fed speeches – including Fed Chair Powell next Tuesday afternoon.

But considering the recency of the Fed rate cut – and all the attention being put toward what the Fed will do next…

A lot of these speeches – especially Powell’s – could have a big effect on the markets.

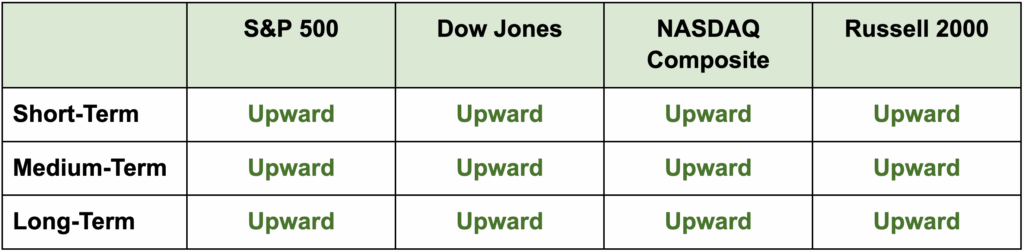

The Daily Direction

Note: Indexes closed significantly higher yesterday, with the Russell 2000 in particular posting a standout gain that sent it to its first new all-time highs in nearly three years. And while they all also opened higher this morning – they’ve been trending downward through the day. All index directions are upward.

The Daily Nugget

An under appreciated rule of the markets – the concentration of gains.

We’ve said this before…

But with Q4 just around the corner – not to mention the Fed having just cut rates – it’s worth mentioning again…

In the markets, gains tend to be concentrated.

There are certain time periods where you could make most of your gains for the year.

And given the environment…

The fourth quarter is shaping up to be just one of those periods.

2022… 2023… 2024 – a lot of the market’s fastest moves happened in the fourth quarter.

And while we are unlikely to see anything like the huge move from the April lows…

With the Fed targeting to cut rates at least two more times this year…

The fourth quarter could still give us a ripping close for the year.

So stay focused and alert for the opportunities that will arise.

Ross will be there to guide you as much as they can…

But ultimately – only you can take the necessary action.

Have a good weekend.

The Traders Agency Team