Hey friend,

We got the latest data for the Fed’s favorite inflation gauge – the PCE Index – this morning.

It came in perfectly in line with expectations – a 2.7% annual increase with the core PCE index posting a 2.9% increase.

We also got personal income and personal spending data, both of which came in higher than expectations.

Finally, we also got consumer sentiment data, which came in below expectations at a four-month low.

Let’s see how the markets have been moving.

The Daily Direction

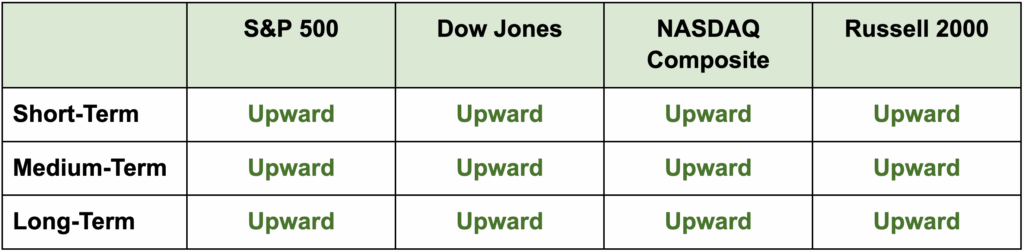

Note: All indexes pulled back again yesterday but opened higher this morning. All index directions remain upward.

The Daily Nugget

Zoom out before you start worrying.

As the market pulls back, you can already start to see the worry building among the more jittery traders.

Of course, the pullback we’re seeing right now is barely a dip…

But even so, this advice still holds.

Before you start worrying, take a moment to zoom out.

This isn’t a mental health thing – it’s about looking at the longer-term trend of the market.

Too often, traders get too caught up in the day-to-day movements…

And their perspective gets “locked” into the short term.

This is what causes market overreactions and contributes to excessive volatility.

On a mass level, this will never stop thanks to human psychology.

But on an individual level, you can be aware of it, avoid groupthink, and use it to your advantage instead.

No one knows for sure how long this pullback will continue.

As Head Trader Ross Givens has pointed out, based on historical data, we shouldn’t be surprised if it extends into October.

Make no mistake, if this happens, it WILL cause quite a bit of market worry.

But if you zoom out and look at the bigger picture, you’ll see that it’s perfectly normal…

And any pullback will only expose juicy buying opportunities.

Ross and his team will be there to help you spot and take advantage of those opportunities.

In the meantime, stop worrying about the markets for a bit – and enjoy your weekend.

The Traders Agency Team