Hey friend,

The big data release this morning was consumer sentiment numbers, which again came in significantly below expectations.

Next week – the Fed makes its much-anticipated move.

The Daily Direction

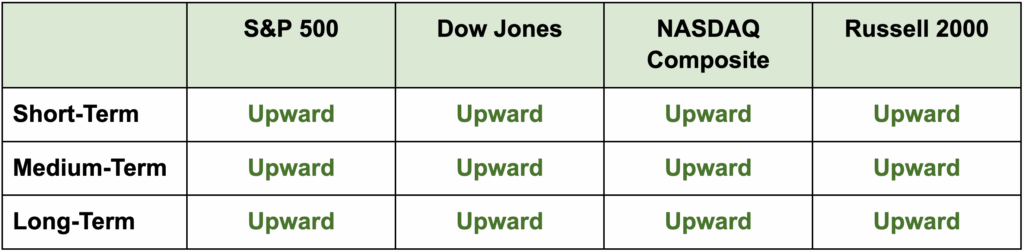

Note: All indexes closed significantly higher yesterday after the CPI and jobless claims report. And while it’s a much more mixed picture today – all index directions remain comfortably upward.

The Daily Nugget

Bears get to feel smart, bulls get to make money.

Why are you in the markets?

Is it to feel smart… to feel satisfaction in being “proven right”?

Or is to make money?

Every trader will say it’s to make money…

But their actions show otherwise…

It shows that they would rather feel smart than make money.

It’s very easy to spot these “traders” once you know what to look for.

For them, a market crash is always just around the corner…

The market is always overvalued…

And the bulls are nothing but naive optimists.

When the market does finally undergo a crash or severe correction (which is perfectly normal)…

They come flying out of the woodwork, crowing about how they were “right all along”.

They got to feel smart.

But did they actually make any money from the crash?

Were they shorting the market?

Were they putting their money where their mouth was?

In the vast majority of cases, the answer is no.

Meanwhile, while the market was going up (as it does the majority of the time)…

Instead of participating in the bull rally, they were too busy warning of the impending crash instead.

Remember, in most cases – bears get to feel smart, but bulls get to make money.

Now, this doesn’t mean there aren’t situations where you want to be either short the market – or on the sidelines completely.

But those are usually just brief, temporary situations.

Most of the time, it pays to be bullish.

It pays to be in the market.

That’s why most of Head Trader Ross Givens’ strategies are bullish strategies…

And why he’s still calling for traders to take advantage of this ongoing bull market – likely to last at least a few more months.

So the next time you see a permabear crying about the impending market crash…

Just ask them this question – “so, are you short the market then?”.

Their answer – or lack of – will tell you everything you need to know.

Have a good weekend.

The Traders Agency Team