Hey friend,

We got the latest consumer sentiment numbers this morning, which came in surprisingly ahead of expectations.

We also got some activity gauges for the manufacturing and services sectors – both of which slightly underperformed expectations.

Let’s see how the markets have been moving.

The Daily Direction

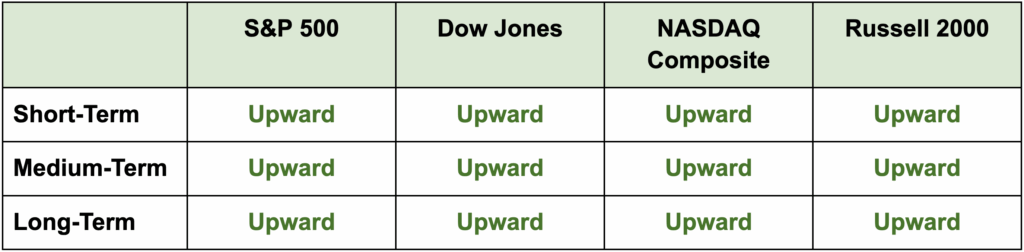

Note: All indexes closed higher yesterday. And while their performance has been mixed today – all index directions are back into the green.

The Daily Nugget

Unless you can rise above the headlines, you’ll always be a slave to it.

We live in a very headline-driven market right now.

Because most retail traders – and even some of the big institutions – are slaves to the headlines.

They react to the headlines…

Making their trades based on what they say – often even abandoning their pre-determined strategies to do so.

That’s exactly how you end up underperforming the market.

The smartest traders understand how to rise above the headlines…

To extract the information within – without taking on any of the emotion.

That part is key.

They want the information about what the headline is saying…

And they also want to understand how the headline will affect other people’s emotions.

But what they don’t want is to have that emotion influence them directly.

This way, they can then intelligently trade based on objective information and other people’s emotions…

Which tends to result in superior trading decisions.

This is how you rise above the headlines.

Of course, this is all easier said than done.

It’s a skill that needs to be developed over time – it won’t come overnight.

But here’s one way you can start doing it.

Next time you read a sensational financial news article (most of them in this clickbait era)…

Ask yourself two questions:

One, what objective information is this headline conveying, if any…

And two, what type of emotions is this headline likely to instill in others?

Do that often enough, and you’ll be surprised at how quickly you’ll be able to develop this skill.

Have a good weekend.

The Traders Agency Team