Hey friend,

The Fed minutes yesterday revealed a lot more hesitation around a December rate cut than previously thought.

However, with the delayed September jobs report showing unemployment ticking up to 4.4%…

And the October jobs report being officially canceled (we’ll get the November jobs report only after the next Fed meeting)…

It looks like the odds of a December cut are ticking up.

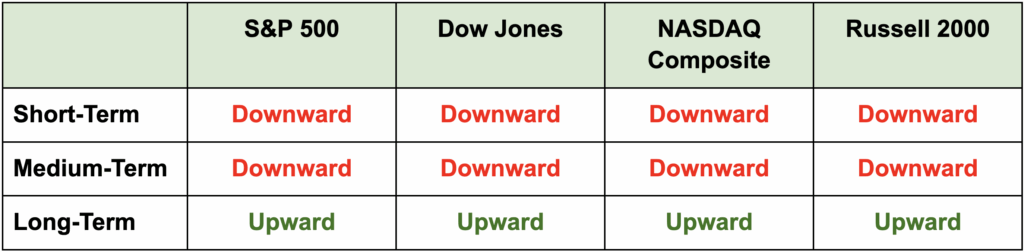

Let’s see how the markets have been moving.

The Daily Direction

Note: Indexes closed flat or slightly higher yesterday. But they all opened sharply higher today on news of Nvidia’s positive earnings and a weaker jobs report – sending multiple index directions back upward.

The Daily Nugget

Information beats emotions.

Most traders allow their emotions to overrule the information (even if they don’t realize it).

One part of this is emotional control – which is a critical skill for traders…

But another big part is that they don’t know how to interpret the market’s information correctly – the other critical skill.

The good news is the two are interlinked.

Because once you learn how to interpret the market’s information correctly – and see the results for yourself…

You’ll naturally develop more confidence in trusting the information instead of your emotions…

Which will in turn make you better at emotional control.

It’s a virtuous cycle that will unlock a whole new level of trading for you.

The caveat? Not all information is created equal.

Certain types of information make for far superior trading decisions.

And that’s why tomorrow morning at 11 a.m. Eastern…

Head Trader Ross Givens is going LIVE for a training session on digging out the highest-fidelity information during earnings season…

The kind of information that could allow you to still do good while the market is doing bad…

And to do great while the market is doing good.

The method Ross will be showing tomorrow has generated gains like 287%… 527%… even 1,091% in both bull and bear markets.

But with bullish momentum looking like it’s rebounding, now is the time to take action.

Click here to secure your spot for Ross’ live training session…

And he’ll see you at 11 a.m. ET tomorrow morning.

The Traders Agency Team

P.S. Planning to attend on a mobile device? Make sure you download the presentation apps now so you don’t miss a second of valuable information.

iOS: https://apps.apple.com/us/app/goto/id1465614785

Android: https://play.google.com/store/search?q=goto&c=apps