Hey friend,

Lots of choppy price action lately.

As delayed economic data potentially starts getting released – expect more volatility.

Let’s see how markets have been doing.

The Daily Direction

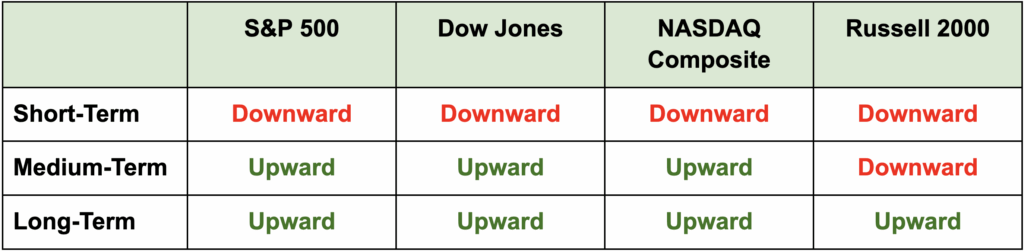

Note: Indexes closed sharply lower – sending the short-term index directions for the S&P 500 and the Nasdaq, as well as the medium-term directions for the Russell 2000 – downward.

The Daily Nugget

Be very careful about extrapolating single-day moves to longer timeframes.

So many traders love to look at one-day market moves – and then make up a narrative about what it means for the longer term.

It happens both ways – both on the bearish and bullish side.

But barring a severe market crash, single-day moves are generally much more noise than signal.

And when you throw in a narrative on top of it – something the media loves doing – it just makes things even more noisy…

Because it’s designed to stir up investors’ emotions.

Don’t get caught up.

Always remember that single-day moves are not a trend – and have little to no predictive value.

Right now, the market is chopping around heavily.

One day it’s sharply up – the next it’s sharply down.

Each time, you get some sort of emotion-stirring narrative attached.

Eventually, a clearer trend will form – and Ross will be the first to let you know where it’s heading.

Until then, don’t let yourself fall for all these single-day narratives.

Have a good weekend.

The Traders Agency Team