Hey friend,

We got the big CPI report this morning.

And it showed inflation slowing to 2.4% annually and 0.2% monthly – below expectations and below the previous months.

Coupled with the weak jobs data, this should give the Fed more justification to cut.

We’ll have a deeper insight into the Fed’s reasoning when the minutes of their latest meeting comes out next Wednesday.

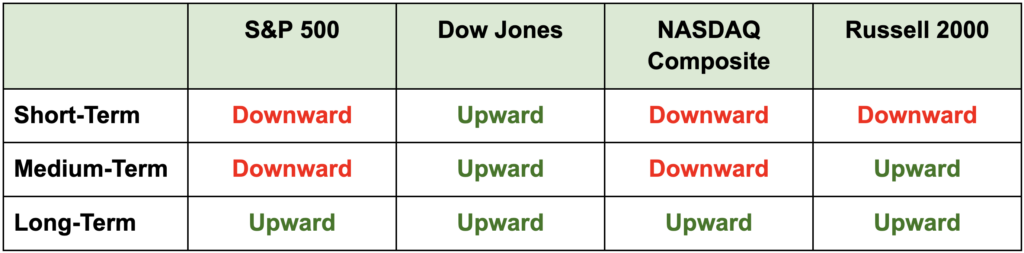

The Daily Direction

Note: All indexes closed sharply lower yesterday but have rebounded slightly today. The short-term direction for the Russell 2000 returned to upward territory.

The Daily Nugget

Fear is one of the best times to buy

Fear is returning to the markets.

You can see it in the headlines…

And more importantly – you can see it in the price action.

AI-driven selloffs…

Software stocks chopped in half…

And a broad market that’s gone absolutely nowhere in the past few months.

Combine all this with the weak jobs data…

Plus a Fed that’s holding back on rate cuts…

And many investors are fearful that this is the turning point before the market flips…

Before we plunge headfirst into a prolonged and painful correction.

The fear is completely understandable.

But fear is also one of the best times to buy…

Because that’s where all the bargains are.

Don’t get us wrong – you don’t want to catch falling knives.

So you do need to be discerning (as you always do).

But don’t neglect the opportunity window we’re entering right now.

Enjoy the long weekend.

The Traders Agency Team