Hey friend,

10-year Treasury yields hit fresh highs, the number of job openings surged more than expected, and traders are now pricing a 29% chance of a November rate hike (from 16% previously).

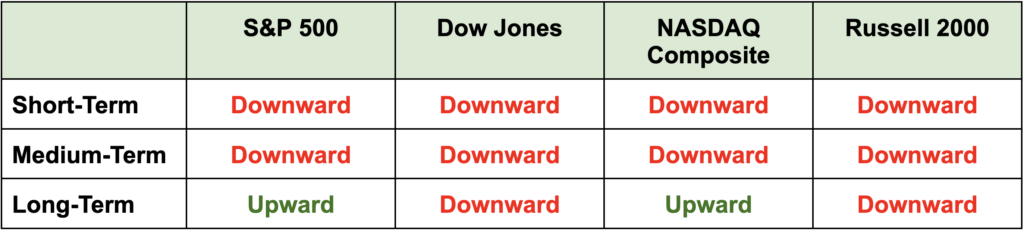

The Daily Direction

Note: All indexes closed lower yesterday – although there were no changes in any directions. After yesterday’s moves, both the Dow and the Russell 2000 have slipped into negative territory for the year.

The Daily Nugget

Different timeframes create different opportunities.

Your timeframe exposes different opportunities.

For example, Warren Buffett doesn’t mind waiting years for his investment to pay off – but he doesn’t care about short-term movements.

On the other hand, traders like us prefer to exploit these short-term movements – we don’t want to wait years for our trades to pay off.

Different timeframes, different types of opportunities.

For instance, Ross Givens expects the market to make a short-term bounce higher, then a final flush lower – followed by the resumption of the bull market.

We’re now entering the short-term bounce stage…

And as short-term traders, this bounce is an opportunity we can exploit.

That’s why Ross Givens is going LIVE right now to showcase his #1 strategy for taking advantage of this potential short-term bounce…

A strategy that has already delivered multiple fast high double and even triple-digit gains this year.

So click here to join him in the live room now…

Before you miss your chance to target some quick profits while everyone else is panicking.

The Traders Agency Team