Hey friend,

We got the delayed third-quarter GDP report this morning.

And it outperformed all expectations, coming in at a 4.3% annual growth – compared to 3.3% expected – on the back of consumer spending.

Still the latest consumer confidence data showed further weakening in December…

Which begs the question – could it be that consumer spending is up, while sentiment keeps going down?

Let’s see how the markets have been moving.

Note: Our offices will be closed for the week starting tomorrow, so expect the next edition of this newsletter to resume next Monday.

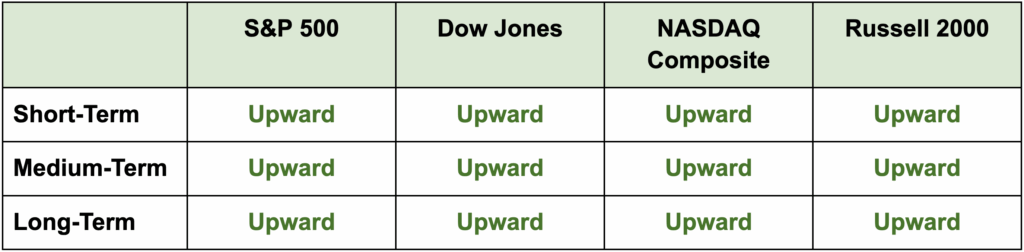

The Daily Direction

Note: All indexes closed higher yesterday but have seen a mixed performance today. Nevertheless, all index directions remain in the green.

The Daily Nugget

Smart traders understand that all opportunities are fleeting.

Yes, it’s true there are always opportunities in the market if you know where to look.

But it’s also true that ALL opportunities are fleeting.

At some point – often faster than most expect – they will expire.

That’s why smart traders are fast actors.

The moment they see an opportunity…

The second they realize the odds are in their favor.

They take decisive action.

This does not mean they’re impulsive – they also safeguard their moves with disciplined risk management.

The combination of these two traits – fast action on opportunities and discipline with risk management – is incredibly powerful.

2025 is almost over, and 2026 is looming.

Think about these two traits carefully…

See how you can apply them more in 2026…

And the odds of you crushing it in 2026 will go up dramatically.

Merry Christmas and enjoy the holidays.

The Traders Agency Team