Hey friend,

10-year Treasury yields, oil prices, and the dollar pulled back slightly yesterday.

Plus, private job growth also came in way below expectations. All this was a positive for the markets.

Ross Givens is expecting a short-term bounce, and so far his thesis looks to be playing out.

The Daily Direction

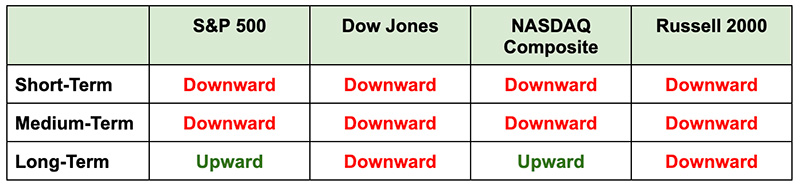

Note: All indexes closed higher yesterday, although not enough to create any change in directions.

The Daily Nugget

Different timeframes also call for different risk management protocols

Yesterday, we talked about how different timeframes expose different opportunities.

The corollary is that these different opportunities also require different risk management protocols.

For instance, if you were buying a deep value stock with a timeframe longer than one year, it wouldn’t make any sense to set a stop loss 10% below your entry point.

But if you were buying a fast-moving stock with the idea of exiting in months or even weeks, then tight stop losses are a very good idea.

Different timeframes create different opportunities which require different risk management protocols.

As you know, Ross Givens is expecting a short-term bounce in the market.

The ideal risk management protocol when exploiting that opportunity is likely to use tight stop losses

(and even progressively move them higher on the winners).

And the ideal strategy for taking advantage of that bounce is Ross’ flagship strategy…

The Traders Agency Team