Hey friend,

While unemployment ticked up in the delayed jobs report, the growth numbers were stronger than expected…

Which led to increased skepticism surrounding a December Fed cut.

Add in to increased fears about an AI bubble – fears that were apparently not quelled by Nvidia’s earnings…

And you had a big selloff yesterday.

This morning, we just had the latest US consumer sentiment data – which plunged to the lowest levels since 2009.

Will this end up being reflected in the stock market?

The Daily Direction

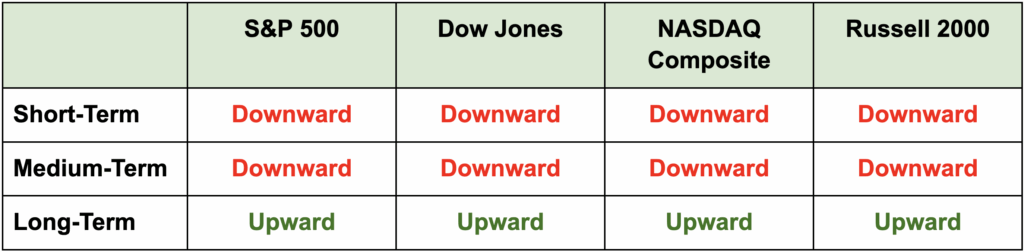

Note: Indexes closed sharply lower yesterday despite gapping up in the morning. All short and medium-term directions are now in downward territory.

The Daily Nugget

The noisier the environment, the more reward in the signal.

Will the Fed cut this December?

Is the entire AI theme a house of cards that’s about to come crumbling down?

Have we reached a market top?

What is the true state of the economy?

That’s just some of the noise that’s bombarding every trader out there right now.

We can see this reflected in the choppy price action…

As well as just how bearish the retail crowd has become.

But the noisier the environment, the more reward there is in the signal.

And that means if you can lock on to the signal in this noisy month…

You’ll be able to come out far ahead of the crowd.

So keep listening to what Ross has to say about the market…

Be very skeptical of what you read in the news…

And remember – there are always opportunities in the market.

Have a good weekend.

The Traders Agency Team