Hey friend,

With a hotter-than-expected inflation print yesterday amid a market bounce, let’s see how markets have been reacting as we close out the trading week.

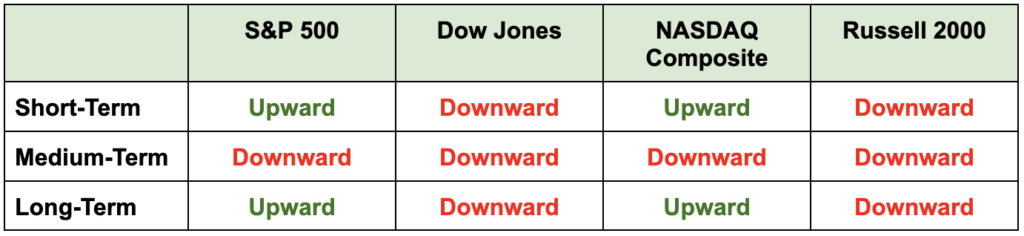

The Daily Direction

Note: All indexes closed lower yesterday – but not as much as one would have expected considering the inflation print. The medium-term direction for the NASDAQ flipped downward, as did the long-term direction of the Dow.

The Daily Nugget

As traders, sometimes we need to zoom out to get more perspective.

We’re traders not long-term investors.

By definition, we’re targeting shorter-term gains – getting in and out of the market fairly quickly – instead of holding on for years or even decades.

There’s nothing wrong with this, of course…

But it can sometimes constrain our perspective of the markets.

Case in point, the market has been pulling back heavily for over two months now, with a technical bounce likely only just beginning.

But did you know that the Dow is only 8% off its all-time high and the S&P 500 is only 10% of its all-time high?

After reading about all the doom-and-gloom for the past couple months, that can really put things into perspective.

The 24-hour news cycle can really force you into a short-term view – and that’s something you have to constantly fight.

So every once in a while, zoom out, look at the bigger picture, and recalibrate. You’ll be a better trader because of it.

Speaking of looking at the bigger picture…

Ross Givens is going LIVE tomorrow at 11 a.m. Eastern to show you his top strategy for making “bigger picture” gains.

It all has to do with a secret “insider signal” most traders don’t even know exist…

Even though it has been responsible for some truly spectacular gains (like a 1,552% open gain right now).

So click here to save your seat for his live session tomorrow.

And Ross will explain the bigger picture you’ve been missing at 11 a.m. ET sharp.

The Traders Agency Team