Hey friend,

Despite all the news that is “supposed” to be bad for the markets, they’ve actually been closing higher for the past couple days.

Is this a sign that the downturn is – for the moment at least – over?

The Daily Direction

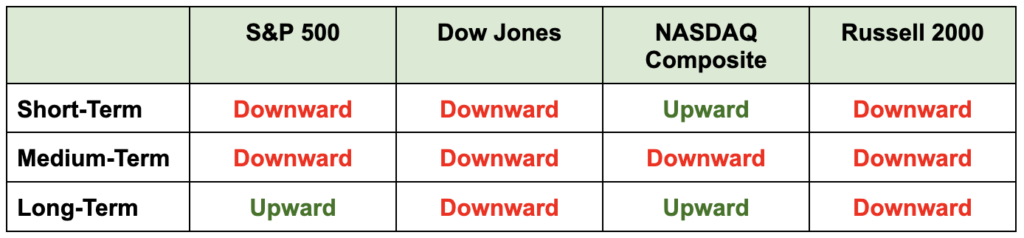

Note: All indexes – including the small-cap Russell 2000 – closed higher yesterday despite the recent escalation in the Middle East coupled with higher oil prices. The short-term direction on the Nasdaq flipped back into positive territory.

The Daily Nugget

Use price action to confirm – or disconfirm – narratives

Because there is no such thing as certainty in the markets, all we have are competing narratives.

Two narratives can be extremely convincing – yet be completely opposed to each other at the same time.

The only way to know which one is correct is by cross-checking it against the price action.

That’s why no matter what Ross Givens’ current views on the market are…

He’s ALWAYS willing to update it based on the price action.

Because price action is the ultimate arbiter – the final word…

And if you don’t listen to it – you’ll be in for a bad time.

Right now, the price action is telling Ross that a market bounce is underway.

And the ideal strategy to take advantage of it…

Is to “ride along” with the big institutional traders (who are the ones driving this market bounce anyway).

Ross developed a strategy for doing just that while working in the heart of Wall Street…

And you can start using this strategy for yourself by clicking here.

The Traders Agency Team