Hey friend,

The small-cap rotation Ross Givens predicted continues…

And the Fed meets this week – where what they say will likely move markets again.

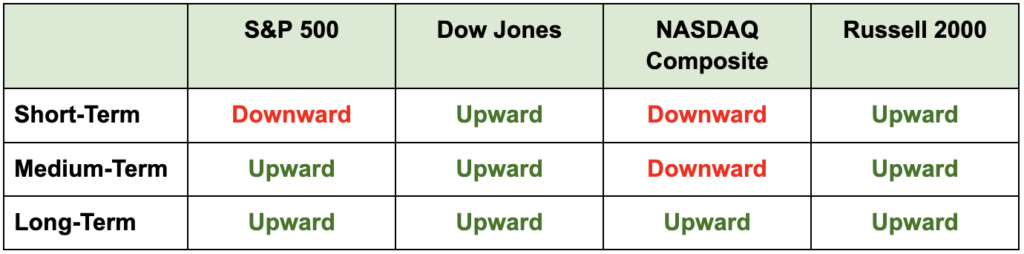

Let’s see how the indexes have been moving.

The Daily Direction

Note: All indexes finished higher to end last week, although it was still a losing week for the S&P 500 and the Nasdaq. The medium-term direction for the S&P 500 flipped back higher.

The Daily Nugget

Disciplined risk management enables intelligent aggression.

By their very nature, individual small-cap stocks have far greater profit potential than larger ones.

That’s what makes the opportunity presented by this ongoing small-cap rotation so lucrative…

Especially with the Fed likely to strike a dovish tone in their meeting this week.

But to make the most of this opportunity you have to be (intelligently) aggressive…

Which means sticking to your risk management parameters even as we go after explosive small-cap stocks.

Disciplined risk management is what enables intelligent aggression.

Keep that in mind when you attend Ross’ LIVE masterclass tomorrow morning at 11 a.m. Eastern…

Where he’ll show you how to go after the highest-potential small-cap stocks using his unique “buying pressure” indicator.

One energy stock this indicator highlighted in end-May surged by 135% just a couple months later…

But with the small-cap rotation ramping up and the Fed meeting this week – these gains could just be getting started.

So, if you haven’t already, make sure you click here to secure your seat for Ross’ live masterclass tomorrow…

And watch out for the login info before it starts.

Ross will see you tomorrow at 11 a.m. ET.

The Traders Agency Team