Hey friend,

Both consumer confidence and new home sales came in lower than expected for August.

However, all this data was collected before the Fed slashed rates last week.

Stocks have continued to inch up regardless.

The Daily Direction

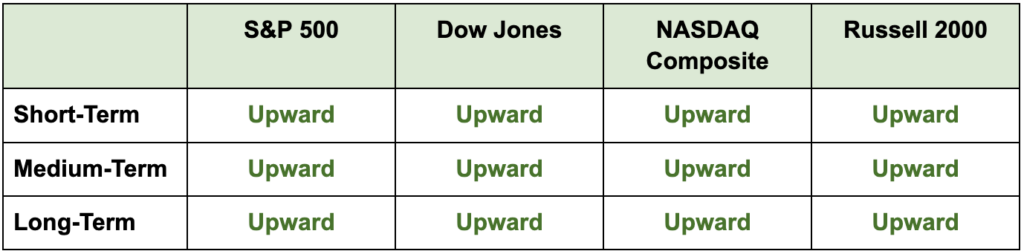

Note: All indexes ended the day slightly higher yesterday, keeping all directions upward.

The Daily Nugget

Markets are forward looking, data is backward looking.

Even the newest freshest data only tells you what happened in the past. It’s always backward looking.

But the market is forward looking. Its job is to price the future and discount it back to the present.

This difference might seem obvious. But it’s a critical one that many traders and investors still don’t understand.

This difference is why sometimes “bad” data creates positive moves in the market, while so-called “good” data causes the market to fall.

It all depends on how the market’s forward view needs to be adjusted based on the data.

What makes trading so challenging is that we can never really know what the market’s forward view is.

We can study the price action and macro narratives. But ultimately, all we’re doing is making educated probabilistic bets.

All good trading is about increasing those probabilities.

That said, some traders inherently have a much greater chance of making higher-probability bets.

Take the institutional investors, for example.

Their probabilities will naturally increase thanks to the sheer size of their coffers, which gives them the ability to move entire sectors.

It may be unfair, but that’s just how it is.

The only thing we can do is use their trading edge for ourselves – and position ourselves right alongside them.

That’s why Head Trader Ross Givens built a special “buying pressure” indicator for spotting these institutional trades.

So click here now to watch him break down exactly how you can start using it for yourself.

The Traders Agency Team