Hey friend,

After CPI data a couple days ago, PPI (Producers Price Index) data just came in this morning.

Combined with the CPI data and the upcoming Fed meeting, the price action over the next week will tell us a lot about the market’s narrative.

The Daily Direction

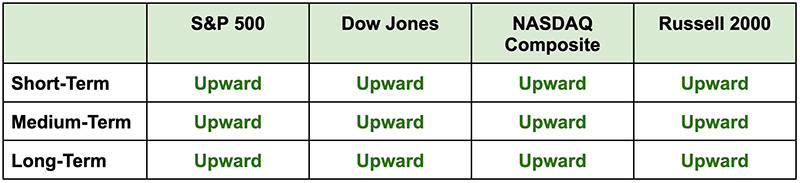

Note: Indexes closed mixed yesterday with the Russell 2000 and the Dow closing slightly higher while the S&P 500 and the Nasdaq closed slightly lower. However, all index directions remain upward.

The Daily Nugget

The hotter the market, the stricter your should be about your buying criteria.

When the market seems like it won’t stop going up – the natural human tendency is to get looser with your buying criteria because it seems like nothing can go wrong.

In reality, you should be stricter about your buying criteria (as well as being stricter about sticking to stop losses and profit taking targets).

Because just as the market rallies when pessimism is at its highest, so too does it fall when optimism peaks.

Now, this doesn’t mean you shouldn’t participate in the current rally…

You just have to be smart and disciplined about it.

That’s why tomorrow at 11 a.m. Eastern…

Ross Givens is going LIVE for a masterclass that will allow you to use one of the most powerful buying criteria there is…

One that could’ve handed you a nearly 20% gain just over the past week.

So don’t miss it – click here to reserve your spot for Ross’ masterclass tomorrow…

And we’ll send you the login details in the morning.

Ross will see you then.

The Traders Agency Team