Hey friend,

Newly-released manufacturing data showing higher input prices stoked inflation fears and weighed on the indexes.

Was the big dip an overreaction? We’ll have to see how the price action unfolds in the next few days.

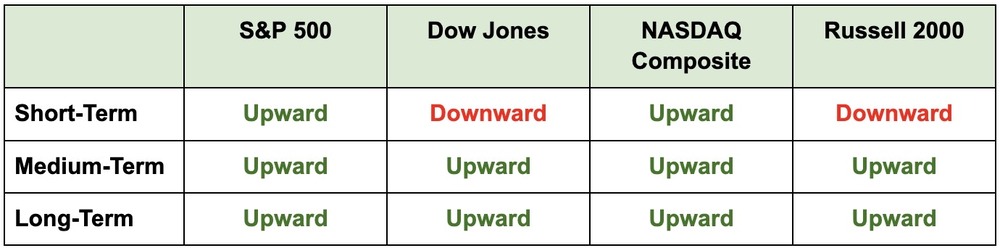

The Daily Direction

Note: All indexes closed sharply lower yesterday – sending the short-term directions for the Dow and the Russell 2000 downward.

The Daily Nugget

Most traders think too black and white

If the market goes up it’s good, if it goes down then it’s bad.

That’s the black-and-white thinking of many traders – especially beginners.

But savvy traders know things are much more nuanced than that.

A sharp rise could be the unsustainable spike before a crash…

While a dip could be the overly optimistic and naive traders being shaken out so the market is free to move higher.

That’s the most likely scenario for what’s happening right now…

Meaning it’s an opportunity for you to position yourself in the leading stocks before they take off higher.

As for how to precisely target these leading stocks?

You want to follow the “fuel” that will actually rocket them higher – the institutional money.

And Ross Givens’ Stealth Trades strategy – which you can pick up for only 99 cents as part of our Memorial Day special – is specifically designed to help you do so.

Take advantage of this deal before the weekend.

The Traders Agency Team